How to find high volume stocks daily with your stock scans.

All the stock screeners covered on this site will help you find high volume stocks. Whether the filter used is ‘relative volume’, ‘high volume for today’, ‘options volume’, or even ‘high intraday volume’. All these volume options are quick and easy to set up and use in a stock screener.

High Volume Stock Screener

High volume usually implies something interesting is going on in a stock. We may not know the why behind the move for some time. The example I show below is a stock that first alerted on a high volume scan, and then alerted again four hours later, on a ‘social media’ screener. The stock was already up over 6% by then.

The stock screener that I feel has the most volume filter options is Trade Ideas, and the examples below are taken from this software.

You can also read the full Trade ideas Review.

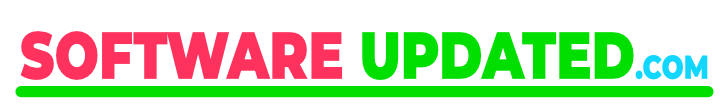

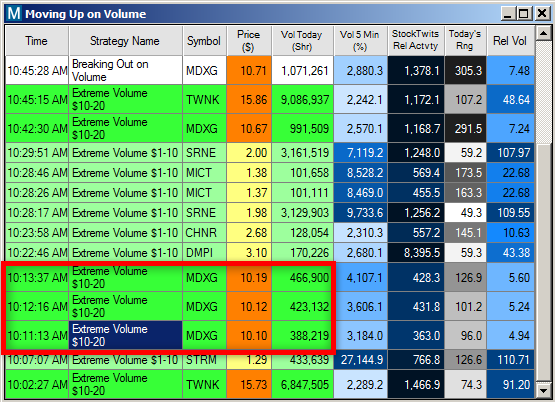

I will briefly mention all the volume filters shown in the screenshot above. These can be used regardless of your trading or investing style. But, it is high intraday volume that I want to focus on, and how you can use it as an edge.

Finding High Volume Stocks.

Trade Ideas volume stock screener filters include:

1) Relative Volume Stock Screener

This compares the current volume for today to the average volume for this time of day, using a ratio.

E.G if you set the ‘Min Relative Volume’ to 3, you will only see stocks which are trading on at least 3 times greater than their normal volume.

This is a good all-round volume filter, and all good stock screeners should offer this filter. If yours doesn’t, it’s time to move on.

2) Volume today.

There are two versions of this. One for the number of shares traded, and one that uses the percent form (%).

E.G. You can screen for stocks that are trading between 200% and 400% above their normal volume.

3) Volume yesterday.

This filter compares the total volume for yesterday to the average daily volume, as a percent value.

E.G. If you set the Min Volume Yesterday to 250%, you will only see symbols which traded on at least two and a half times their normal volume yesterday.

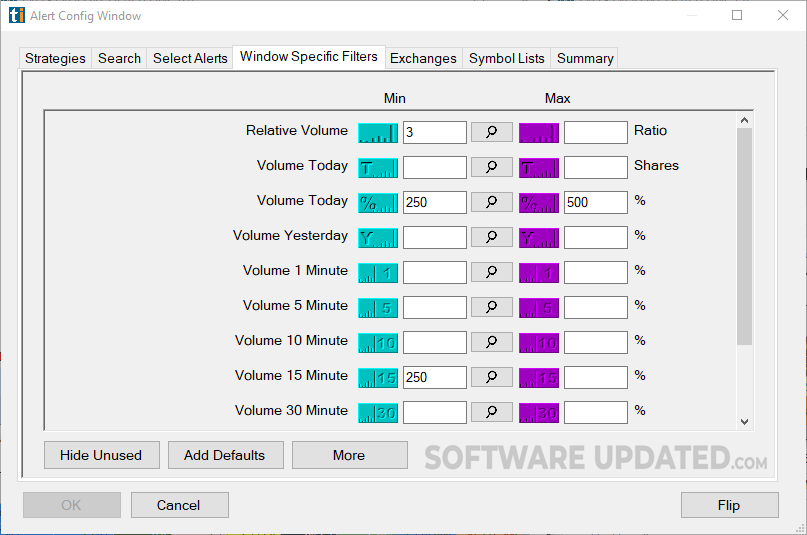

4) Stock Options Volume Screener.

There are two versions of this in Trade Ideas. You can filter on the number of options contracts traded so far today. Or you can compare the number of contracts traded today to the number of contracts the same stock usually trades in an entire day.

E.G. Options screen for unusually high options volume.

Set the minimum value to 200%. This will only show stocks which have already traded twice as many options contracts today, as they trade on a normal day.

Other options volume filters include put and call contract volumes. See the screenshot below.

5) Intraday Volume Screener.

Intraday volume filters cover the last 1 min, 5 min,10 min, 15 mins, or 30 min.

These filters are expressed as a percentage.

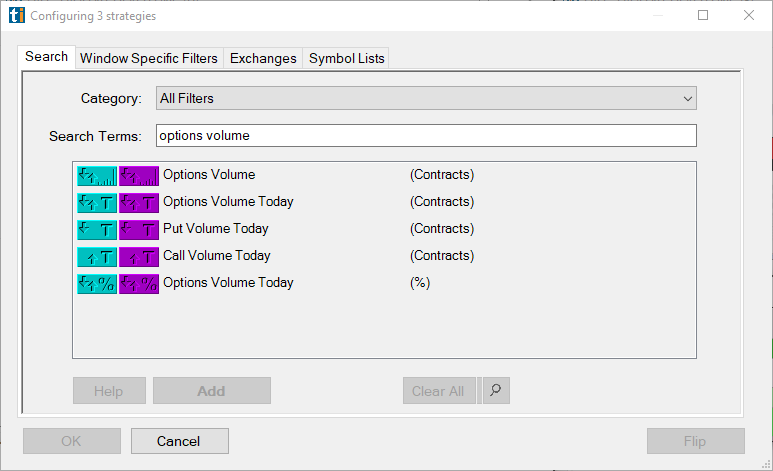

E.G. If we set the minimum volume to 250%, this will only show stocks where volume is at least 250% greater than normal in the last 15 minutes.

Clicking on the magnifying glass icon in the screener settings will show a description of the filter. See the screenshot below.

This is pure gold for Active Traders who are looking for strong momentum trades.

What’s even better is that these intraday volume filters work premarket and after regular market hours. A great way to find stocks that are moving premarket.

This is just one of the areas where Trade Ideas stands out from the crowd. The amount of intraday volume data that it can quickly scan and then produce real-time alerts is really amazing.

A high Intraday Volume Stock Screener Example.

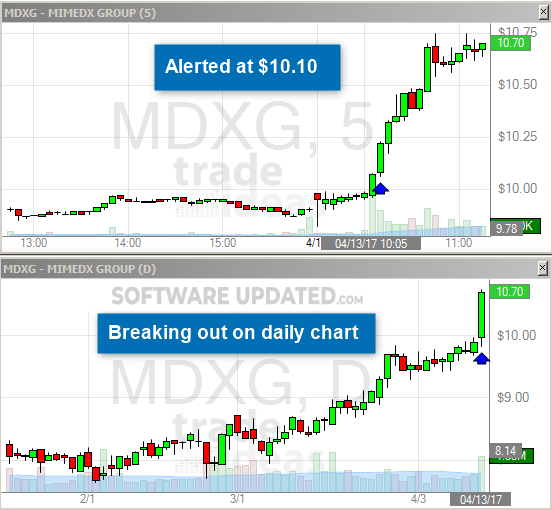

In the screenshot above MDXG alerts under a screener strategy called ‘Extreme Volume $10-20’, at a price of $10.10.

The 5 Min and daily chart are shown below.

The small blue arrow shown in the 5 min and daily chart were triggered by the Trade Ideas software, at the time of the alert.

As well as extreme volume on the 5-minute chart, the daily chart also shows a breakout on high volume; useful for ‘end-of-day’ investors.

Using high intraday volume scans, gives you an edge. The alerts will allow you to get into the trade before those investors who aren’t using these tools. The stock market consists of people taking a bite of the cake, before passing it on to the next person. You need to get your bite of the cake early.

By cake, I mean price. The market maker gets a better price than the high frequency trader, who in turn gets a better price than the day-trader.

And this goes on, from day-trader to swing trader, to end-of-day investor, to the weekend investor.

By using high intraday volume scans and alerts, gives the active trader an edge. However even the ‘end-of-day’ investor, who has to work for a living, can take advantage. The trick is to examine how the high volume daily bar formed; by studying the intraday volume/price action that took place to form the daily bar.

The ‘end-of-day’ investor, who makes the effort to perform stock scans daily, would have got in before the weekend investor. Stock screeners take away the need to stare at a screen all day, so even long term investors can benefit from the alerts generated.

The chart below shows how a high intraday volume scan would have enabled early entry; before the social media crowd were alerted to the stock. There was a gain of about 6% before the second alert.

However, even the ‘social activity’ alert would have got you in before the weekend investors, as the stock went on to rise to over $16.

Summary

When it comes to finding high volume stocks, Trade Ideas has some of the best filter options for volume, particularly intraday volume.

If you are a Day Trader or Swing Trader and want to find trades like these, give it a try.

Try Trade Ideas with Promo Code SST15 to get 15% off the first month or first year of your subscription.

Alternatively, for those that want more technical indicators and some fundamental data, try TrendSpider.

Disclosure: We are reader-supported, and this article may contain affiliate links.